Published January 23, 2026

Should You Wait to Buy a House in Statesville NC? Here's What the Data Says

.png)

Should You Wait to Buy a House in Statesville NC? Here's What the Data Says

"You may delay, but time will not." - Benjamin FranklinMost homebuyers in Statesville and Iredell County don't miss opportunities because they made the wrong move. They miss them because they waited for certainty in a market that doesn't pause.

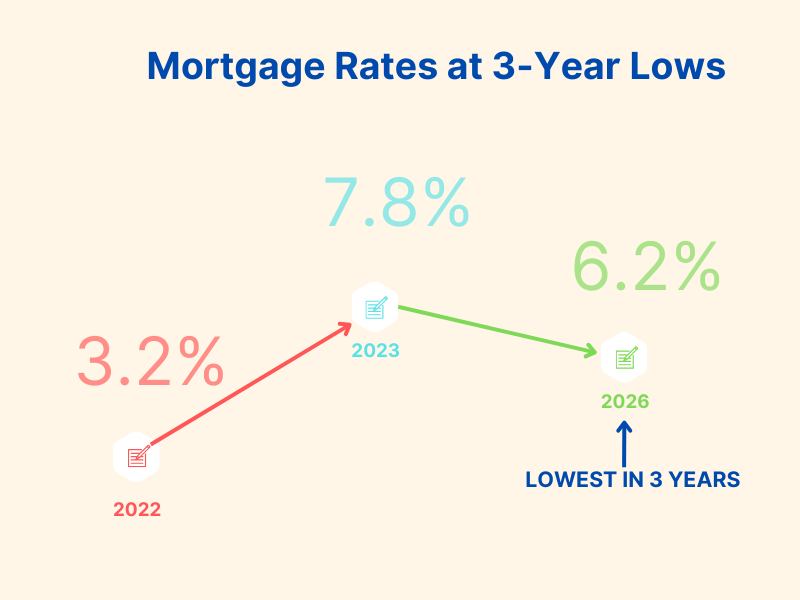

Timing the market is nearly impossible, but what I can tell you with near certainty is that buyers in our area have a small window of opportunity right now. With interest rates dropping to 3-year lows and seller fatigue creating unprecedented buyer leverage, this is one of those rare moments where several factors line up at the same time. And they don't usually stay lined up for long.

When this happened in 2020, no one was ready for the explosion of home values. This time, I'm trying to prepare you.

What Statesville Homebuyers Have Seen Over the Last Year

Let's start with what's real and observable in our local market, not what's on the national news.Over the past year, buyers in Statesville and Iredell County have had something they haven't had in a long time:

- More homes on the market

- More price reductions

- More incentives

- More seller concessions

- Fewer competing offers

Sellers are tired—not desperate, not giving homes away, but weary.

Many sellers listed expecting a fast sale. Their expectations were unmet. The fast sale didn't happen. They reduced prices. They waited. They carried the house longer than planned.

That seller fatigue matters. It creates leverage for buyers—leverage that disappears quickly once demand picks back up.

Why Interest Rates Are Dropping (And What It Means for Statesville Buyers)

A lot of buyers have been saying, "We're waiting for rates to get into the 5s."Well, here we are. Rates are the lowest we've seen in roughly three years. And while they may continue to move, what matters more is why they're moving.

Recently, housing giants Fannie Mae and Freddie Mac were ordered to buy hundreds of billions of dollars in mortgage-backed securities.

That's a mouthful, so let's break it down in everyday terms—the way I explained it to my 19-year-old son, Brady.

The "Brady Version" of How Mortgage Rates Work

Here's how it works in real life:- You get a mortgage from a bank

- That bank gives mortgages to a lot of people

- Those mortgages get bundled together

- Fannie and Freddie buy those bundles and sell them to investors

Because when those agencies step in and buy more loans:

- Banks get their money back faster

- Banks have more money to lend

- Easier access to money = better rates

The Hidden Cost of Waiting to Buy in Iredell County

Waiting feels responsible. It sounds smart to say: "We'll just wait and see what happens."But in real estate, waiting often costs more than acting.

Here's what typically happens when rates start coming down:

- Buyers who've been sitting on the sidelines re-enter the market

- Demand increases

- Inventory tightens

- Sellers stop offering concessions

- Prices begin trending up again

The people who "waited for confirmation" usually end up buying later at:

- A higher price

- With more competition

- With fewer negotiating options

This isn't a "date the rate, marry the house" message. While that advice has merit, I want you to be strategic—not just hopeful about future refinancing.

This Isn't About Timing the Market Perfectly

There is no crystal ball. No one can time the market perfectly.But you can recognize moments when conditions favor buyers.

Right now, buyers in Statesville have something rare:

- Downward moving rates

- Elevated inventory

- Motivated and weary sellers

- Real negotiating power

Markets don't swing slowly. They shift quietly—and then suddenly.

By the time you hear on the news that it's a "good time to buy," the advantage is already gone. You missed the boat.

Why This Matters Even More for Statesville and Iredell County

Now let's talk about our area specifically.The greater Charlotte market continues to grow rapidly. It was reported in August 2025 that 157 people move into the Charlotte region PER DAY.

When prices rise closer to the city, buyers don't disappear—they move outward.

We saw this clearly during the COVID years:

- Urban prices jumped

- Buyers pushed into surrounding counties

- Rural and suburban markets followed

- Homeowners in higher-priced markets in other states flooded our local market, paying cash for houses—making it incredibly hard to compete

Statesville and Iredell County are directly in the path of that expansion.

As affordability tightens in urban cores, surrounding areas feel the impact next. And that is upon us. It has been for the last 4 years.

When that happens:

- Inventory shrinks faster

- Prices rise quicker

- Competition increases

Seller Fatigue in Statesville Won't Last Forever

Here's something buyers need to understand clearly:Seller fatigue is temporary.

Sellers adjust expectations. Markets stabilize. Confidence returns.

When homes start selling faster:

- Concessions disappear

- Price reductions stop

- Negotiations tighten

Sellers are actively watching too. It will not surprise me when sellers pull their houses off the market to reset and raise prices based on market movement.

What Waiting Could Cost You as a Statesville Homebuyer

Waiting doesn't mean nothing happens. It usually means:- You lose the ability to negotiate closing costs, repairs, and other concessions

- You compete with more buyers later—often driving up the price in multiple offers

- You pay more for the same house

- Due diligence and earnest money (your skin in the game) costs you much more

- You stretch affordability further

This isn't meant to be a scare tactic. It's a call to get prepared, if you're already considering buying.

What NOT to Do (Even in a Good Market)

I don't want you to:❌ Buy a house that doesn't fit your needs

❌ Buy a house that doesn't fit your budget (foreclosures stink)

❌ Put yourself in a position where you regret moving too quickly

How to Buy Smart in Today's Statesville Market

What I do want you to do if you're considering buying a home in Statesville or Iredell County:1. Get Fully Approved with a Great Lender

Not just a quick prequalification—a full approval.This gives you information to make good, fast decisions when you need to. You'll know what your rate is, what your payment is, and you aren't scrambling to pull it out of a hat at the last minute with a terrible lender.

2. Hire an Experienced, Active Real Estate Agent

Go through the buying process again with them so you know what to expect. Things change in real estate!3. Decide Your Non-Negotiables

- Area/neighborhood

- School districts

- Commute times

- Must-have features

4. Decide What You're Flexible On

- Age of house

- Layout

- Yard size

- Cosmetic updates

Next Steps for Statesville Home Buyers

I am a big believer in real estate being a large wealth determiner. This is the time to jump.If you want to talk to me directly about what the right move is for you, please reach out. I am an advocate for you. If the time is right, I will tell you. If it's not, I'll tell you that too.

Ready to explore your options in Statesville or Iredell County?

Schedule Your Buyer Consultation

Get Pre-Approved Today

Search Statesville Homes

Jill Galliher is CEO of Galliher Home Team, serving homebuyers and sellers throughout Statesville, Iredell County, and the greater Charlotte region. With deep local market expertise and a commitment to honest guidance, Jill helps clients make informed real estate decisions that build long-term wealth.

.png)